Financial Services is undergoing a major digital transformation. Technological advances are changing the very core of the business - making transactions and related processes automated. With automated and digitalized services, banks and other financial organizations are looking for effective ways to retain old and attract new customers.

Research suggests that FinServ organizations will be able to differentiate themselves from others with the quality of customer service. Thus, organizations are reverting their strategic focus to transforming the way they approach, talk to, and acquire clients in the digital age.

They need to respond to emerging market trends and double down on digital communication channels. However, they once again need to be mindful of staying within the boundaries of data privacy regulations.

Emerging customer service trends

83% of independent financial advisors argue that better technology tools would greatly improve new client acquisition, which is ever more important in an increasingly competitive landscape. Moreover, 15% of millennials reported that the “use of social media tools such as Facebook and LinkedIn” was the most important variable when selecting a financial advisor.

Research also shows the following:

- Customers that are fully engaged with their banks generate 37% more revenue.

- Retail banks that regularly optimize customer experience 3.2x faster growth than their competitors.

- Financial services are ranked second-to-last when it comes to being customer-centric, with the only government being ranked lower.

In today’s growing digital age, customers expect 24/7 asynchronous communication as it relates to their specific financial needs. Organizations in Financial Services recognize this need, and as Harvard Business Review research shows, improving the customer experience is among the top-five business priorities in 2022 for 64% of FinServ companies.

To summarize, FinServ organizations need to meet their old and new clients where they are - on digital channels. However, they need to ensure still that customer data is protected and privacy isn’t compromised.

With additional layer of industry-specific regulations, banks and other financial institutions are searching for tailored customer communication solutions that will meet their security standards.

Introducing digital capabilities in FinServ

Financial Services is shifting its focus from operations and processes to customer engagement. Providing excellent customer service on digital channels and devices will become a differentiating factor for competitive advantage.

How can FinServ institutions meet their client’s growing digital needs?

Meeting customers where they are

Consumers are getting used to reaching their service providers on channels of their choice - meaning websites, their favorite social media, email, instant messaging solutions, and more. Banks and other financial institutions have steered away from this approach in the past, but now they must adapt to support their existing customers and attract new ones.

That’s why introducing omnichannel customer support is crucial. Enabling your customers to reach you via live chat on your website, in-app chat, WhatsApp, SMS, and other channels makes you easy to reach and eliminates the frustration of being put on hold on the phone or going to the bank in person.

Moreover, adding video conferencing as a replacement for live meetings is a good way to increase your customers’ satisfaction and save them precious time.

Self-service capabilities

Customers not only expect their needs to be met on their favorite channels but also to resolve some of their issues on their own. Organizations need to lay critical groundwork for an autonomous future — one in which finance operations are increasingly driven by artificial intelligence and other technologies, reducing the need for human intervention.

In this case, this means chatbots and other self-service capabilities such as self-scheduling meetings and knowledge bases.

This new approach to customer attraction and engagement relies on giving the customers the freedom to help themselves. Customer service can be at their disposal if their issues get more complex. Still, self-service capabilities can allow customers to find the answers to their questions even outside your working hours.

Personalization

2021 Consumer banking Report research shows that 34% of retail banking customers want more personalized human-to-human interaction with banks and credit unitions. This means that customers that still want and need human-to-human interaction should be given the means to achieve it.

As mentioned above, video conferencing is a digital “replacement” channel for in-person meetings. Adopting it as a way to talk to customers means reducing customers’ and personnel’s valuable time while giving undivided attention to your clients’ needs.

Data protection and regulatory compliance

FinServ is a heavily-regulated industry that works with sensitive customer data. As customers are more and more privacy-conscious, it’s important to protect their data and retain a positive business reputation.

Solutions for customer engagement in FinServ need to be GDPR-compliant and employ the highest data security standards and protocols, such as end-to-end encryption. We see more and more organizations deploying their solutions on-premise to remain fully in control of their data management, thus minimizing potential data breaches.

Provide the experience your clients expect with Rocket.Chat

Rocket.Chat helps financial institutions build trusting relationships with their clients by making communication - with clients, partners, and coworkers - more secure.

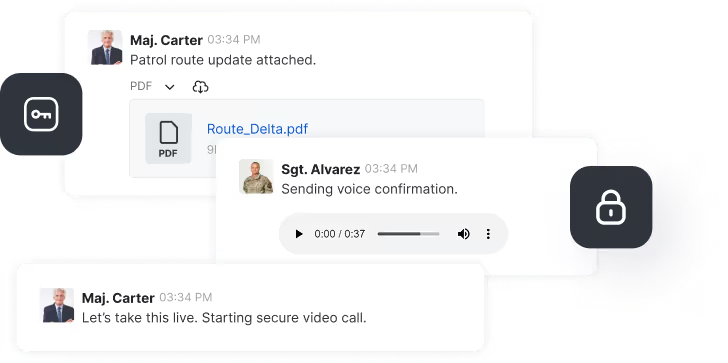

All your financial conversations can be centralized under a single, white-labeled messaging app provided by Rocket.Chat. Some of the conversation-oriented and security features that Rocket.Chat supports include:

- Active directory integration

- End-to-end encryption

- On-premise deployment for complete control of your data

- Supports compliance with GDPR and HIPAA

- Single sign-on

- Chatbot automation

- Full conversation history

- Omnichannel communications

- Retention, archival, and export of communications.

Find out more about how Rocket.Chat can help you engage and retain your clients.

Frequently asked questions about <anything>

- Digital sovereignty

- Federation capabilities

- Scalable and white-labeled

- Highly scalable and secure

- Full patient conversation history

- HIPAA-ready

for mission-critical operations

- On-premise and air-gapped ready

- Full control over sensitive data

- Secure cross-agency collaboration

%201.svg)

- Open source code

- Highly secure and scalable

- Unmatched flexibility

- End-to-end encryption

- Cloud or on-prem deployment

- Supports compliance with HIPAA, GDPR, FINRA, and more

- Supports compliance with HIPAA, GDPR, FINRA, and more

- Highly secure and flexible

- On-prem or cloud deployment

.avif)